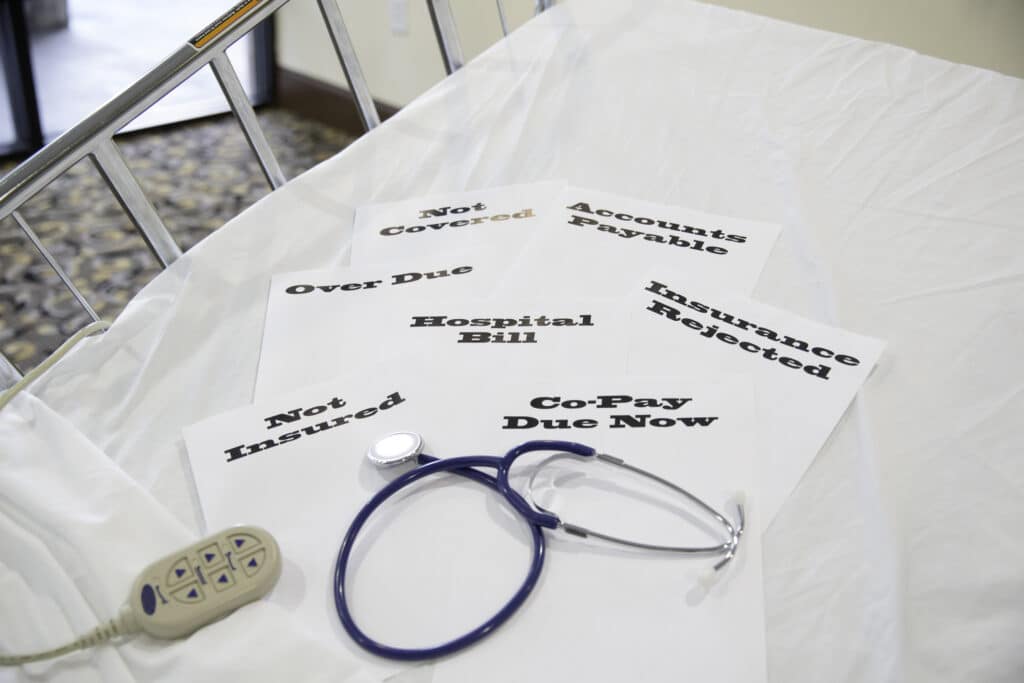

The Copay Surprise

The Texas Bleeding Disorders Coalition recently announced—with pride— that HB 999 passed unanimously, 31-0, in their Senate. This bill will eliminate copay accumulator adjuster programs on state health plans in Texas. Patients with many chronic conditions and no generic options will no longer be penalized by CAAPS and will have access to their life saving medication. This is the result of the hard work of so many over the last two legislative sessions.

What are accumulators, and why are they so important to those with bleeding disorders? Read a two-part article by Paul Clement to learn more.

Insurance Company Efforts to Thwart

Patient Assistance Programs

By Paul Clement

Hemophilia therapies—both factor and emicizumab—are extraordinarily expensive, potentially costing several hundred thousand dollars per year. Families must pay monthly premiums to buy health insurance coverage. They also must budget for the plan’s deductible (the amount you must pay before the plan starts covering some of your health care costs). And they must pay coinsurance on factor purchases (the percentage of the cost you must pay out-of-pocket [OOP], which may vary from 10% to 40%). These expenses must be paid until families reach their out-of-pocket maximum for the year, after which the plan picks up all costs.2 For a family with a child with severe hemophilia, this means budgeting for as much as $18,000 out-of-pocket, often within the first three months of the year. Few families can afford this expense.

To help meet these OOP expenses, factor manufacturers offer financial assistance to patients using their product, with annual assistance limits varying between $12,000 and $20,000, depending on the company and the product. Assistance is typically offered in the form of a card, often referred to as a “copay card”, “copay coupon card” or “savings card.” The card is presented at the time of service—such as to the pharmacist when picking up factor. The pharmacist will process the prescription using your insurance information as the primary payer and the copay card information as the secondary payer.1

Patient assistance programs are a godsend for families trying to make ends meet. So what’s the problem?

Insurers view these programs negatively, as a marketing tool for pharmaceutical companies to entice consumers to select more expensive brand-name drugs instead of lower-cost generic versions. This viewpoint may be valid for some drugs, but it doesn’t apply to factor or emicizumab, because there are no lower-cost generic forms of either type of drug. Insurance companies selling commercial insurance may also offer employers “cost savings” programs which thwart the use of patient assistance programs. And employers may opt to implement these programs, not realizing that, while saving money, they are also throwing some of their employees into financial ruin.

There are two insurance programs which target patient assistance:

Accumulator Adjuster Programs (AAP): The AAP are also known as copay accumulator programs. These insurance plan programs do not count a pharmaceutical manufacturer’s copay assistance payments towards the patient’s deductible or OOP maximum. The manufacturer copay card pays for prescriptions until the maximum value on the card is reached. Once it’s reached, your OOP costs begin counting toward your annual deductible and OOP maximum.

In a normal scenario involving copay assistance and no AAP in place, you would use the copay card to pay down your deductible and pay the coinsurance on your factor, both of which normally count toward the annual OOP maximum. Ideally, by the time the copay card is used up, you will have reached your OOP maximum, or be very close to it, and the insurance company will then pick up all costs for the year.

With an AAP in place, you would initially not see anything amiss, and the copay card would appear to be working as usual, and you would have no OOP costs for the first few factor shipments.

But then, usually around the third or fourth factor shipment, the copay card is used up and you are unexpectedly hit with the “copay surprise”—a bill for several thousand dollars. Only then do you learns that your deductible and coinsurance have not been paid down by the copay card and you are now on the hook for several thousand dollars in costs each month until you reach your out-of-pocket maximum for the year.

Many hemophilia patients report not knowing their insurance plan implemented an AAP until they experienced the copay surprise. That’s because most health care plans are not up front about implementing an AAP and often use deceptive language, describing the AAP as a “benefit,” when, in fact, it is just the opposite.3

Thanks to advocacy efforts by nonprofit foundations like the NHF and HFA, sixteen states have banned AAPs, and a few other states have similar legislation in the works. Because of pushback on AAPs, insurance companies over the last few years have been switching to a different type of program to limit copay assistance, called a copay maximizer.

Next week: Copay maximizers, and more

- Some programs have restrictions, such as income limits, on who may qualify for their program. Assistance in meeting OOP expenses may also be covered by private organizations.

- Some plans, usually HMO plans, may have no deductible or coinsurance. Most commercial health insurance plans have both an annual deductible and coinsurance.

- BlueCross BlueShield of Texas calls it “Coupons for Individual Plan Members Only. ”CVS Caremark calls it “True Accumulation.” Express Scripts calls it “Out of Pocket Protection.” United Healthcare calls this “Coupon Adjustment: Benefit Plan Protection.”