It’s hard to know where to begin to discuss what’s happening in healthcare insurance now… and what will become of the advances made with the Affordable Care Act (“Obamacare”). Right now, consider some great advice from a young man with hemophilia who had to fight for what he needed. We might all need to do this if repeals on the ACA are made. (Taken from

PEN’s Insurance Pulse newsletter 2015)

When Goliath

Insured David: How to Get What You Need When the Giant Doesn’t Listen

Patrick

James Lynch

The rules seem to keep changing even though I’ve had the

same insurance plan for several years. How do I make sure I don’t get any

unpleasant surprises in January?

Anyone with a bleeding disorder knows that navigating the

healthcare system can be extremely difficult, and sometimes a downright

nightmare. Unfortunately, our community’s size—or lack thereof—puts us in a

vulnerable position; there simply isn’t enough education or understanding about

our needs, and this happens on the medical side (hematologists and nurses) as

well as on the business side (insurance and reimbursement specialists).

I have

severe hemophilia A. In early 2014 I needed a new insurance plan. I’d moved

from New York to California. I didn’t know much about the healthcare culture in

California, so I contacted a navigator—a person trained to assist people

seeking health coverage through the Affordable Care Act’s Marketplace. I knew

she’d worked in hemophilia, and thought her expertise would help me select a

plan. She pointed me toward a plan with Sanitas Healthcare*, and I enrolled.

Sanitas

Healthcare works differently than most health insurance companies. For one,

it’s not just a health insurance company; it’s an integrated delivery system

(IDS), a network of healthcare organizations operating under one umbrella. The

IDS model is one example of a managed care system that’s grown more popular in

recent years as a means of making healthcare coverage cost-effective for the

insurance provider. Sanitas is not only a health insurance provider, but the

company owns the hospitals its patients must visit under their plans, employs

the doctors its patients can see, and controls the pharmacies where its

patients receive medication. In lay terms, Sanitas controls everything. It’s

gigantic, with over 9 million patients across eight states plus Washington, DC.

Sanitas has over 174,000 employees, and in 2013, it reported $53.1 billion in

revenue. Yup, billion. Sanitas is the

largest managed care organization in the United States.

Enrolling

with Sanitas I felt safe. Unfortunately, Sanitas turned out to be a terrible selection

for someone with hemophilia, especially an adult patient—something my navigator

friend was not aware of because she’d worked in pediatrics.

Member Services: How Can I Not Help You?

The first problem emerged immediately with the wrong information

from Member Services. I was told I was unable to schedule an appointment for the

first five weeks following registration. This included not being able to order

factor until a Sanitas doctor wrote me a new prescription. Multiple customer

services agents confirmed that there was no way around this protocol. Yet I

found out later from a Sanitas executive that what I’d been told directly

contradicted company policy: new patients are

able to fill an active script from another doctor when they first enroll with

Sanitas to ensure continuity of care.

During

these five weeks, I made numerous phone calls to Member Services; I was

repeatedly disconnected, shuffled through a seemingly endless phone tree, or

left voicemails that were never responded to.

When I was

finally able to make appointments, I was told by Member Services that in order

to see a hematologist, I first needed a referral from a primacy care physician

(PCP). I argued that I have hemophilia, a chronic bleeding disorder, and have

records from a PCP visit within the last six months. This argument was

fruitless; I had to see a PCP first. Later, I again learned that this is not

Sanitas policy.

When I saw

the PCP, I learned it would be at least another week until I could see the

hematologist, and then another five days until the factor prescription written

by this hematologist would be ready at the pharmacy. I asked if the PCP would

write my prescription, but he wasn’t comfortable with that. When I stressed

that I was running out, he wrote a “holdover prescription” for one week’s

supply.

Got Factor?

When I tried to pick up the holdover prescription a few days

later—because I’d already been told many times that Sanitas didn’t provide home

delivery—the pharmacy could not find my factor. One pharmacy employee actually

said, “We lost it.” I was shocked, but because the hematologist appointment was

only a few days away, I decided to wait. My supply continued to dwindle.

At my

hematologist appointment, I found myself in the role of teacher, explaining

microbleeds, trough levels, and so on. The hematologist repeated many of the

same procedures the PCP had done, checking my blood pressure and heart rate He

didn’t measure or closely examine my joints. For a company that prides itself

on its data, I was surprised that this hematologist didn’t measure anything. As

the appointment ended, I received my full prescription for factor.

Days later,

a pharmacy employee called. She had my factor, but she said that because my

policy expired on March 31, 2014, she would not release it. I told her she was

incorrect because my policy didn’t even begin until April 1, 2014. She

forwarded me to Member Services. After the phone rang for a solid five

minutes—I’m not exaggerating; I timed it—I was disconnected.

Throughout,

I made over 50 calls, spent over 400 minutes on the phone, and spoke to dozens

of employees who gave me incorrect information about Sanitas’s policy regarding

newly enrolled patients, receiving chronic medication, home delivery options,

the ability to see a specialist for a chronic condition, my account status, and

my payment records.

Do I Have Your Attention Now?

Fortunately, I documented my entire experience, so when it

became clear that I needed to take more aggressive action, I had detailed

notes. I wrote a pointed, aggressive, but professional open letter to Sanitas

and posted it on my Stop the Bleeding! Facebook page, then shared the post on

my Twitter account and with my email list. In less than 72 hours, my letter

received over 8,000 unique reads. A senior staff member at Sanitas contacted

me, and I requested an in-person meeting with various senior staff to discuss

the litany of problems I had experienced.

The meeting

was granted. I met with the medical director, pharmacy director, COO of

clinical operations, and head of hematology/oncology. It was a semi-productive

meeting. The senior staff heard my complaints and informed me of changes they’d

already made to their “onboarding” new-patient enrollment process to better

account for new patients with chronic diseases. The pharmacy director changed

certain internal policies and implemented some education for her staff as a

result of my complaints. She also agreed to put in writing that home delivery

of factor for people with hemophilia was available on request. On the clinical

side, I insisted that the overall quality of care was nowhere close to that

offered by an integrated comprehensive care model such as an HTC, but it was

clear they weren’t interested in making clinical changes. Instead, they

insisted that the comprehensive care they offer is on par with an HTC’s. When I

insisted that the care was simply not equal, they agreed to “look into it,” but

nothing ever came of that.

Getting White-Glove Treatment

It’s been roughly one year since that meeting. I’m receiving

a tremendous amount of attention from Sanitas. Clearly, I’m the “problem child”

and receive white-glove treatment so I don’t cause any more PR headaches. Many

flaws remain in Sanitas’s system for people with rare, chronic conditions, not

the least of which is uninformed Member Services reps who are often the first

contact for new patients. Fortunately, a focused effort is being led by two

strong advocates in our bleeding disorder community who are collecting stories

and organizing an action plan to effect reform at Sanitas.

Here are

five guidelines everyone with a bleeding disorder should follow when engaging a

new healthcare company or medical service provider:

1.

You are the expert. It can be tempting to

relinquish control and responsibility to an authority figure such as a doctor

or pharmacy director, but you can’t afford to. You must be an expert on

yourself. It’s your body. It’s your life. Own it, take responsibility for it,

and fight for what it needs.

2.

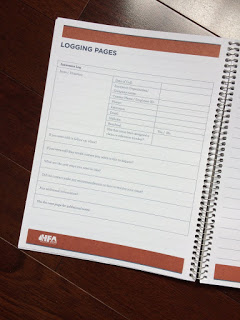

Log everything. Many large companies and

institutions have myriad people who answer phones or respond to emails; these

people often work with minimal information, minimal accountability, and minimal

incentive to go beyond the basic call of duty. Keep track of everything: names,

dates, times, badge numbers—even the simple act of asking reps for this

information subtly informs them that you are to be taken seriously, and if

needed, you’ll have a record of your experience.

3.

Follow up again. And again. And again.

Unfortunately, people don’t always say or do what they claim they will. Keep at

them. Don’t allow uninformed or unmotivated employees to compromise your

healthcare. Keep to your agenda until you receive the positive outcome you

deserve.

4.

Use our community. The bleeding disorder

community is lucky to have empowered and educated advocates. I was overwhelmed

by the number of people who offered to help me during my crisis. In this

community, when you reach out, people will reach back. Don’t be ashamed to ask

questions and ask for help. We’re here for each other. We are each other’s

rock.

5.

Stay positive and solutions-driven. No matter

how noble the fight, nobody likes a rude, angry, or unprofessional fighter.

It’s important to be assertive, aggressive, and diligent, but it’s unacceptable

to be cruel or to behave inappropriately. If the system is broken, point out

the flaws, and offer what you can to help fix it. We can’t view these companies

and their staff as enemies; they’re not! They’re our allies. But a lack of

adequate education coupled with laziness, defensiveness, or irresponsibility

can create catastrophe.

My experience facing a true, personal healthcare crisis was

eye-opening, but I knew my own personalized healthcare needs, documented

everything, stood my ground, and was able to articulate my needs to the

company’s executives. Being your own advocate is not an easy process, but it’s

manageable, empowering, and necessary. Always keep in mind that advocating for

yourself is also advocating on behalf of everyone in our community.

Patrick James Lynch, 29, has severe hemophilia A. He is

co-founder and president of the digital content agency Believe Limited, through

which he created and produces the award-winning hemophilia comedy series Stop

The Bleeding! (stbhemo.com) and the inspirational speaker series Powering

Through poweringthrough.org). He’s the 2013 recipient of HFA’s Terry Lamb Award and the 2014 recipient of NHF’s Loras Goedken Award. He

lives in Los Angeles, California. Read an in-depth account of his experience at

patrickjamslynch.com.

* The company name

has been changed for anonymity.